Navigating IRS-Mandated Reasonable Compensation

Unraveling the IRS Maze: Your Guide to Avoiding Costly Pitfalls and Maximizing S-Corp Success

What is “Reasonable Compensation”?

Reasonable Compensation refers to the fair and justifiable payment that S-Corp owners or shareholders receive for the services they provide to the company. It’s a crucial concept in tax compliance and corporate governance, ensuring that owners are compensated at a level that reflects their roles and responsibilities within the S-Corp. The IRS mandates that S-Corps must pay their owners a salary that aligns with industry standards and their job functions, preventing them from significantly reducing their tax liability by underreporting income as distributions. Accurate Reasonable Compensation is pivotal in maintaining transparency, avoiding audits, and upholding the integrity of an S-Corp’s financial operations.

What’s the big deal?

Reasonable Compensation matters significantly for S-Corps as it determines the fair compensation business owners should receive for their services. Ensuring an accurate and compliant Reasonable Compensation figure is vital, as it not only avoids IRS scrutiny and potential penalties but also safeguards the financial health and reputation of the S-Corp. It’s the cornerstone of tax compliance and sound financial management, making it a critical element for long-term business success.

What’s the risk?

There are huge risks of not complying with the IRS Reasonable Compensation rules:

- Payroll Tax Complications

- Back Taxes

- Reclassification of Distributions to Payroll

- Penalties, Late Fees, and Interest

- Potentially Flagged for Future Audit Scrutiny

Why take the risk when Meer’s Accounting can proactively ensure that you are in compliance with applicable law & regulation so you’re prepared.

What can you do NOW?

Meer’s Accounting offers a pivotal solution: our expert team can prepare a comprehensive Reasonable Compensation report tailored to your S-Corp’s unique needs. This report serves as your roadmap to ensure compliance with IRS regulations, providing actionable insights that guide S-Corp owners on setting fair compensation. With Meer’s Accounting, you’ll gain the confidence and clarity needed to make informed decisions and safeguard your S-Corp’s financial stability. It’s just a few clicks away – let’s get an appointment on your calendar with Meer’s Accounting.

MEET PEGGY VANGORDER, EA

Don’t worry, an expert is here to help.

To shield your S-Corp from the looming dangers of an audit triggered by Reasonable Compensation errors, you need expert guidance. Peggy Vangorder with Meer’s Accounting is an Enrolled Agent with the IRS and ready to serve as your trusted ally in navigating these treacherous waters. With her by your side, you can rest assured that your Reasonable Compensation is accurate, compliant, and audit-ready. Don’t wait for the audit alarm to sound; take proactive steps to safeguard your S-Corp’s financial well-being today.

Why Meer’s Accounting?

Choosing the right partner.

Choosing the right partner to navigate the complexities of Reasonable Compensation and ensure the financial health of your S-Corp is a critical decision. Here’s why Meer’s Accounting stands out:

- Proactive Approach

- Comprehensive Financial Services

- Peace of Mind

- Exceptional Expertise

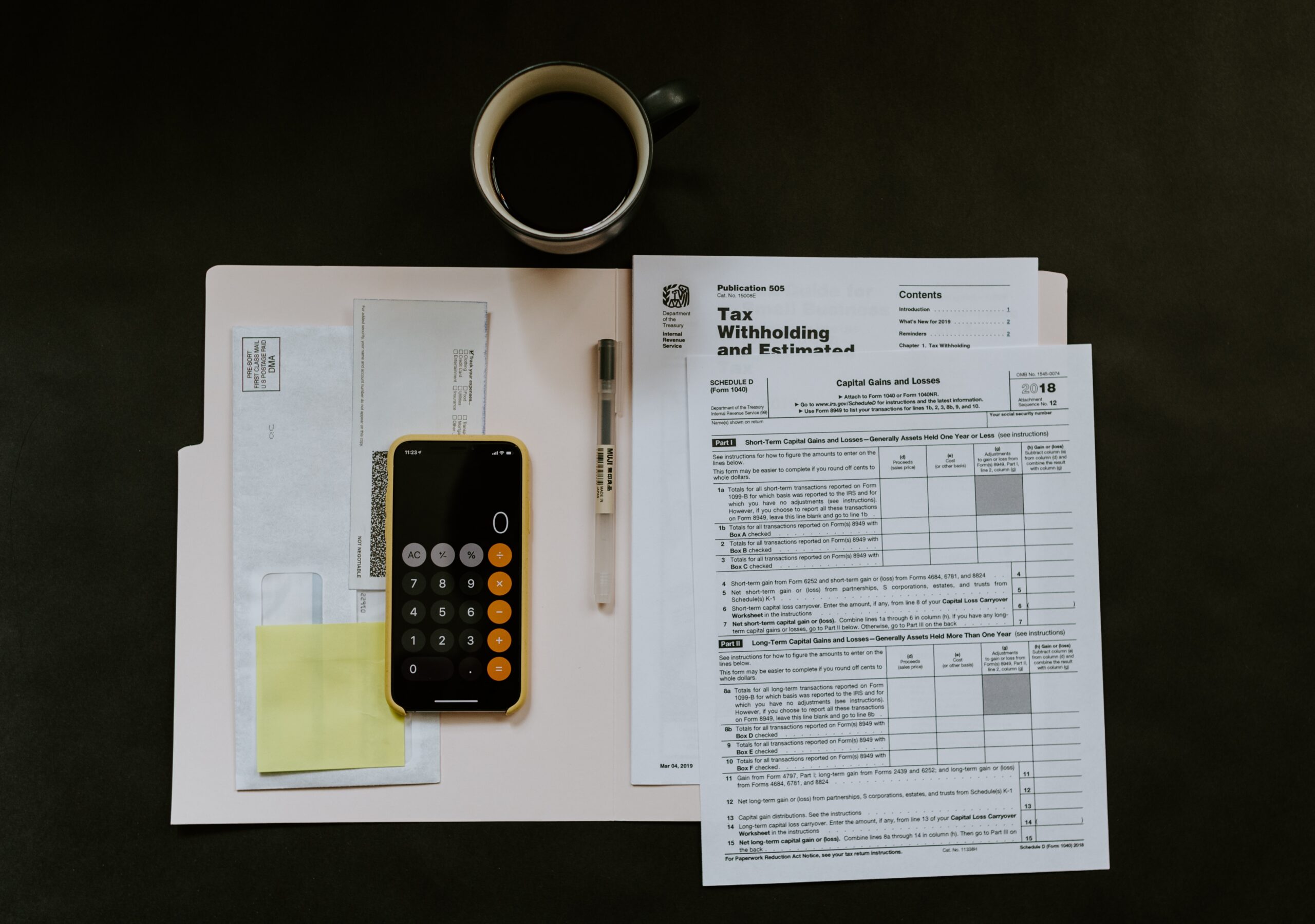

Are you prepared for an audit?

Reasonable Compensation errors in your S-Corp can trigger IRS scrutiny, penalties, and legal troubles. Don’t wait until you’ve received a notice of audit from the IRS in the mail. Protect your financial well-being with Peggy Vangorder’s expert guidance at Meer’s Accounting.

Don’t wait until it’s too late to make current year adjustments…

Contact Us

Meer's Accounting can't wait to serve you. Here are a few ways to contact us.

(417) 986-3370

Serving Everywhere from Branson, Missouri

Regular Hours: M-F: 8am-5pm, S-S: Closed

Tax Season Hours: Mon-Sun: 8am-8pm

Get in touch

Send us an e-mail by completing the form below. Please do not send any tax documents through this form.